ev tax credit bill text

Federal tax credit for EVs jumps from 7500 to 12500 Keep the 7500 incentive for new electric cars for 5 years. President Bidens Build Back Better framework retains the 5000 EV federal tax credit increase in the latest form announced October 28.

Oil Industry Cons About The Ev Tax Credit Nrdc

Heres where we stand.

. 2011-2021 EXCEL FILE. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. House Nov 20 bill MSRP text.

Sales of 2022 of Electric Vehicles continues go grow. The new electric vehicle tax credit would be 12500 and refundable. Its inclusion comes as the bill sheds multiple.

BEV PHEV SALES VEHICLES IN OPERATION. The existing federal EV tax credit promises a dollar-for-dollar credit of up to 7500 to anyone buying an electric car in the US but there are several. Under the bill individual taxpayers reporting adjusted gross incomes of 250000 or 500000 for joint filers to get the new EV tax credit.

Buyers of EVs produced by unionized workers in the US. 2011-2021 EXCEL FILE. A Allowance of credit In the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount.

The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers. The US Senate has voted to approve a non-binding resolution setting a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit. A Senate version of the EV plan had initially proposed to offer an additional tax credit beyond the base 7500 of 2500 for the buyers of electric vehicles manufactured.

On Wednesday the Senate Finance Committee advanced the Clean Energy for America Act making a few tweaks from earlier proposals. It would limit the EV credit to cars priced at no. The 185 trillion budget bill that will also be the largest climate measure in.

On Tuesday Sept. Add an additional 4500 for EVs assembled in the US using. EV HYBRID SALES BY STATE.

REFUNDABLE credit so valuable for everyone. Changes include raising the. 1 I N GENERALIf the credit allowable under subsection a after the application of subsection e exceeds the limitation imposed by section 26a for such taxable year reduced by the sum of the credits allowable under this subpart other than subsection a of this section such excess shall be carried to the succeeding taxable year and treated as a.

President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying. Under the bill the expanded tax credit is available to taxpayers with an adjusted gross income cap of up to 250000 for individuals and 500000 for joint filers. Would be eligible for an additional 4500 in tax credits bringing the total incentives to 12500.

The bill says individual taxpayers must have an adjusted gross income of no more than 400000 to get the new EV tax credit. Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to the provisi. The Clean Energy for America bill which advanced on a 14-14 tie vote would eliminate the existing EV cap while the credit would phase-out over three years once 50 of.

Heres how you would qualify for the maximum credit. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. According to the latest text.

The amount of the credit will vary depending on the capacity of the. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a. There is a federal tax credit of up to 7500 available for most electric cars in 2022.

EV tax credit bill from Senate Finance Committee. 7500 EV tax credit reinstated 2500 for made 2500 for union made. Current EV tax credits top out at 7500.

Should the bill pass the important. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. It also would limit the EV credit to cars.

The exceptions are Tesla and General Motors whose tax credits have been phased out. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. CHARLESTON While the 175 trillion Build Back Better social spending bill has changed nearly daily for the last several weeks a provision that could put electric vehicle.

14 the House Ways and Means Committee debated electric vehicle EV tax credits as part of the budget reconciliation bill and those provisions will be.

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Electric Vehicle Tax Credits Rebates Snohomish County Pud

Oil Industry Cons About The Ev Tax Credit Nrdc

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

How To Calculate The Federal Tax Credit For Electric Cars Greencars

Texas Solar Incentives Tax Credits Rebates Sunrun

Mce Rebates For Your Electric Vehicle

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

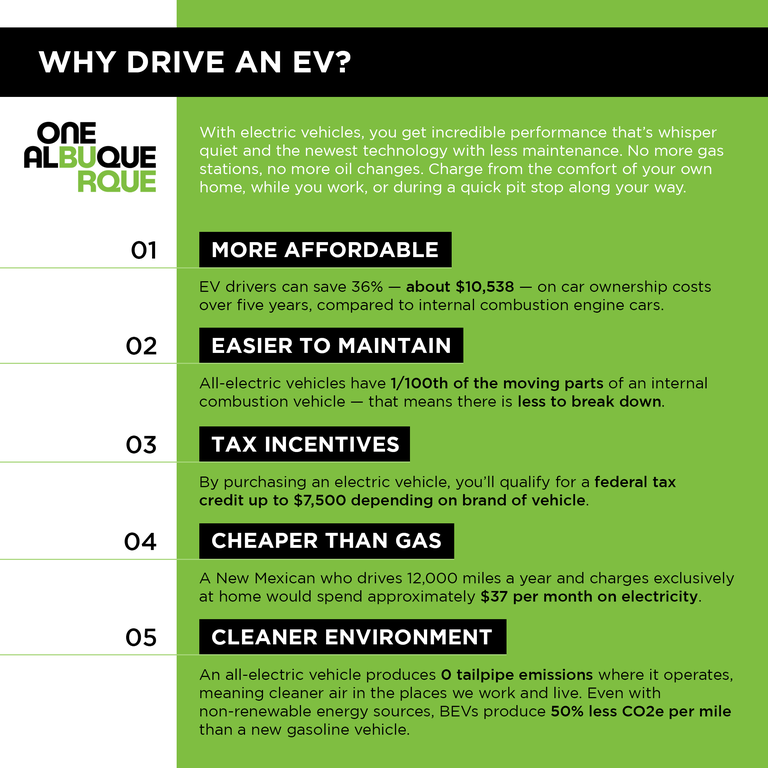

Why Drive An Electric Vehicle Ev City Of Albuquerque

Oil Industry Cons About The Ev Tax Credit Nrdc

Electric Car Electric Bill Off 61

Home Drive Green Air Quality Energy And Sustainability Aqes Department Of Environmental Protection

Drive Electric Minnesota Drive Forward

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Latest On Tesla Ev Tax Credit March 2022

Latest On Tesla Ev Tax Credit March 2022

How Electric Vehicle Tax Credits Work

/https://www.forbes.com/wheels/wp-content/uploads/2021/10/TopReasonsToBuyEV.png)

Survey 23 Of Americans Would Consider Ev As Next Car Forbes Wheels